Page 30 - Life In Naples March 2022 Flipbook

P. 30

Insights from Tom Moran,

Founder, Chief Executive Officer,

Senior PIM Portfolio Manager, Moran Wealth Management

ART Iinflation. While there are overt signs that inflation is here, the your situation and pursuit of strategies designed to protect your

Please talk to your Financial Advisor or give us a call to discuss

n my recent conversations with clients, there was one topic

that seemed to be at the forefront of everyone’s mind —

portfolio from inflation. One option is to invest in equities with

question remains if it will stay. At first, the Federal Reserve and

strong dividend history and a healthy balance sheet. Historically,

after

dividends have risen faster than the rate of inflation, acting as a

Jerome Powell insisted that inflation is merely transitory due to

the unwinding of the pandemic. They recently, however, started to

much-needed hedge against inflationary pressure. Many dividend-

DARK change their tune suggesting that inflation may be more persistent. oriented companies are also value stocks, so we anticipate value

In order to evaluate how long inflation is here to stay, we need to

stocks continuing to outperform growth stocks in the short

take a step back and look at why we are experiencing inflation in

and medium-term. When inflation increases above 4%, equities

the first place.

traditionally start becoming less favorable for investors than other

1

asset classes. If this is the case, we recommend clients discuss

Broadly stated, inflation is a sustained rise in prices caused by

more dollars chasing the same amount of goods and services. In

is most appropriate for them. At Moran Wealth, we offer multiple

the depth of the crisis, the Fed provided liquidity to the financial other investment options depending on their situation and what

system and the U.S. government passed truly enormous amounts proprietary Private Investment Management (PIM ®) portfolios

of fiscal stimulus to both companies and the American consumer. that may be appropriate for clients wanting to protect their

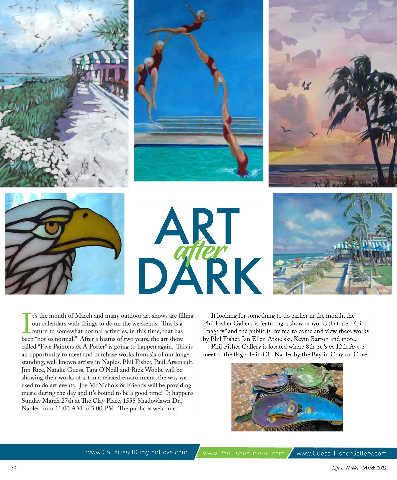

t’s the month of March and many outdoor art shows are filling If looking for something to do earlier in the month, the

Those actions prevented a greater economic crisis and enabled assets against inflation. In order to evaluate your portfolio for its

our calendars with things to do on the weekends. This is a Phil Fisher Gallery is featuring a show of works that are “Epic

a rapid recovery. Demand is back—and expected to grow—but sensitivity to inflation, please reach out to set up an appointment

Ireturn to somewhat normal activities, in this time, that has Imagery” and the public is invited to come and view these works

you can’t restart an entire economy overnight. The disrupted with one of our financial advisors.

been “not so normal.” After a hiatus of two years, the art show by Phil Fisher, Jan Ellen Atkielski, Kevin Barton and more.

supply chains and labor shortages are still sorting themselves out,

called “Five Painters & A Potter” is going to happen again. This is Phil Fisher Gallery is located where 8th St S & 12th Ave S

causing wild price movements for goods and commodities such 1 https://www.barrons.com/articles/inflation-is-good-news-

an opportunity to meet and purchase works from six of our long- meet at the flagpole in Old Naples by the Bay, in Crayton Cove.

as used cars, coffee and lumber; shortages for everything from for-stocks-with-high-dividends-51621170002

standing, well known artists in Naples. Phil Fisher, Paul Arsenault,

semiconductors to caramel syrup. Even Dollar Tree is raising their

Jim Rice, Natalie Guess, Tara O’Neill and Rick Wobbe will be

prices on some items above $1. However, this chaos in supply

showing their works of art in a relaxed environment, the way we

chains should eventually calm, restoring a measure of normality to Tom Moran

used to do art events. Joe McNichols & Friends will be providing

the prices of many goods. Chairman Powell likely referred to this Founder, Chief Executive Officer, Senior PIM Portfolio Manager

music during the day and it’s bound to be a good time! It happens

process when he talked about elevated inflation readings being P: (239) 393.8076 | F: 239-431-5239

Sunday March 27th at The Clay Place, 1555 Shadowlawn Dr., Thomas.Moran@MoranWM.com

“transitory.” The elephant in the room is whether the Fed’s actions

Naples from 11:00 AM to 5:00 PM. The public is welcome. www.MoranWM.com

on monetary policy have the potential to create lasting inflation

5801 Pelican Bay Blvd, Suite 110, Naples, FL 34108

that can negatively impact the markets and the broader economy

for years to come.

Equity securities are subject to market risk which means their value may fluctuate in response to general Investing in foreign securities presents certain risks not associated with domestic investments, such as currency

economic and market conditions, the prospects of individual companies, and industry sectors. Investments in equity fluctuation, political and economic instability, and different accounting standards. This may result in greater share

securities are generally more volatile than other types of securities. There is no guarantee that dividend-paying price volatility.

www.GalleriesOfCraytonCove.com www.PhilFisherFineArt.com www.Guess-FisherGallery.com stocks will return more than the overall stock market. Dividends are not guaranteed and are subject to change or disclosure document for a full description of our services. The minimum account size for this program is $50,000.

The PIM program is not appropriate for all investors. Please carefully review the Wells Fargo Advisors advisory

elimination.

Investment products and services are offered through Wells Fargo Advisors Financial Network, LLC WFAFN).

Moran Wealth Management is a separate entity from WFAFN. 1021-03944

30 Life in Naples | March 2022 Life in Naples | March 2022 31