Page 30 - Life-in-Naples-Magazine-AugSeptOct-FullSpreads

P. 30

Insights from Don Drury

President, Moran Wealth Management

lthough investors do not have a crystal ball, certain nonetheless. Th is inversion historically

economic metrics can help investors and business owners has predicted seven out of the eight

Amake informed decisions on the direction of the economy. past recessions and has had one false

2

For instance, leading economic indicators can signal changes in positive in 1994. On April 1, 2022,

the economy before they occur. One of the most well-known we briefl y saw the two-year

leading economic indicators is the Yield Curve, which conveys the Treasury note top the 10-year

relationship between short-term and long-term interest rates on Treasury note at 2.44%

treasury bonds. versus 2.38%, signaling to

Financial experts argue that the slope of the yield curve investors another recession

can predict future economic activity. In a normal economic may be impending. It is

landscape, the curve is upward sloping with the short-term rate important to remember

lower than the long-term. To understand why, it is useful to think that a recession does not

about treasury bonds as essentially investors lending money to the follow immediately after

U.S. government. As the maturity of a bond increases, investors an inversion. On average, a

expect to be compensated for the increased risk of lending their recession comes 19 months

money over a longer period. Th is relationship between short-term after the two-year and 3

ART by expectations of the Fed’s monetary policy, while long-term mind, we believe that we

and long-term rates can change, however, with the curve fl attening

10-year yield inversion.

and even inverting. Short-term rates are primarily infl uenced

With all of this in

remain at a crucial turning

rates are set by investor’s outlook on infl ation and economic

growth. A normal, upward sloping curve indicate investors predict

point in the economy

future economic health and market expansion. When investors

as the Fed embarks on

aft er

start to anticipate the economy slowing down in the future, this

aggressive monetary

DARK curve inverts with short-term bonds yielding higher than long- policies to combat

term bonds. Th is yield curve inversion signals investors have a

infl ation. Here at Moran

pessimistic long-term economic outlook and are willing to pay a

Wealth Management,

premium on shorter term bonds.

we are actively

Traditionally, economists look at the diff erence between

watching for changes

the three-month and the 10-year Treasury note to determine the

possibility of a future recession. Economists pay attention to this

indicators including

metric because it has reliably predicted the last eight recessions in leading economic

the yield curve and

1

consecutively, including the Great Recession of 2008. As of June encourage you to reach

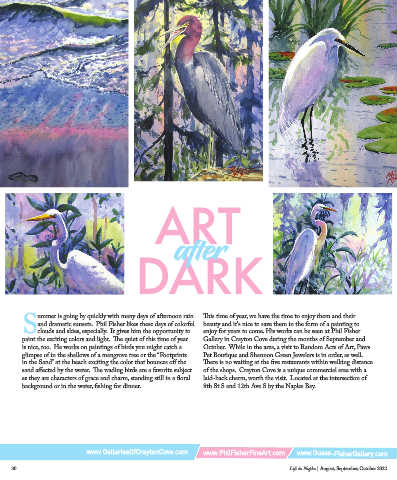

ummer is going by quickly with many days of afternoon rain Th is time of year, we have the time to enjoy them and their 23, 2022, the spread between the three-month and the 10-year out to us regarding any

and dramatic sunsets. Phil Fisher likes these days of colorful beauty and it's nice to save them in the form of a painting to Treasury has remained positive. Th e spread of the two-year and questions or concerns.

Sclouds and skies, especially. It gives him the opportunity to enjoy for years to come. His works can be seen at Phil Fisher 10-year Treasury note, on the other hand, does not have a perfect You may contact us at

paint the exciting colors and light. Th e quiet of this time of year Gallery in Crayton Cove during the months of September and track record of predicting a recession, but is still signifi cant, your own convenience

is nice, too. He works on paintings of birds you might catch a October. While in the area, a visit to Random Acts of Art, Paws on our mainline

glimpse of in the shallows of a mangrove tree or the “Footprints Pet Boutique and Shannon Green Jewelers is in order, as well. 239-920-4440

in the Sand” at the beach exciting the color that bounces off the Th ere is no waiting at the fi ve restaurants within walking distance or schedule an

Donald E. Drury President

sand aff ected by the water. Th e wading birds are a favorite subject of the shops. Crayton Cove is a unique commercial area with a appointment at

P: (239) 920.4448

as they are characters of grace and charm, standing still in a fl oral laid-back charm, worth the visit. Located at the intersection of moranwm.com.

F: (239) 431.5239

background or in the water, fi shing for dinner. 8th St S and 12th Ave S by the Naples Bay.

don.drury@moranwealthmanagement.com

1 www.barrons.com

www.MoranWM.com

2 Ibid

5801 Pelican Bay Boulevard, Suite 110, Naples, FL 34108

LPL Research

3

Th is article contains general information that is not suitable for everyone and was prepared for informational purposes only. Nothing

contained herein should be construed as a solicitation to buy or sell any security or as investment advice to any reader. Th e article

is an advertisement for Moran Wealth Management in its capacity as a registered investment adviser. Th e article contains certain

forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors,

www.GalleriesOfCraytonCove.com www.PhilFisherFineArt.com www.Guess-FisherGallery.com actual results may diff er materially. As such, there is no guarantee that any views and opinions expressed herein will come to pass.

Past performance is not a guarantee or predictor of future performance.

30 Life in Naples | August, September, October 2022 Life in Naples | August, September, October 2022 | August, September, October 2022 31 31