Page 91 - LIN JAN 2022 WEB FILES

P. 91

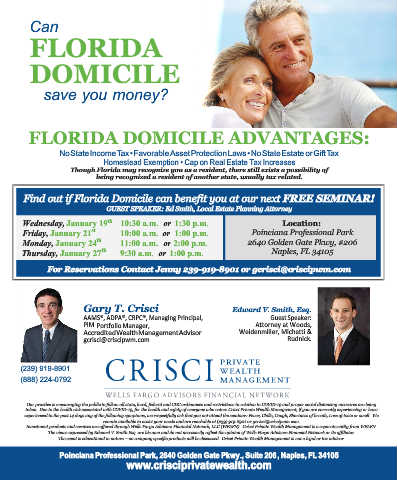

Can

FLORIDA

DOMICILE

save you money?

FLORIDA DOMICILE ADVANTAGES:

No State Income Tax • Favorable Asset Protection Laws • No State Estate or Gift Tax

Homestead Exemption • Cap on Real Estate Tax Increases

Though Florida may recognize you as a resident, there still exists a possibility of

being recognized a resident of another state, usually tax related.

Find out if Florida Domicile can benefit you at our next FREE SEMINAR!

GUEST SPEAKER: Ed Smith, Local Estate Planning Attorney

Wednesday, January 19 10:30 a.m. or 1:30 p.m. Location:

th

Friday, January 21 10:00 a.m. or 1:00 p.m. Poinciana Professional Park

st

th

Monday, January 24 11:00 a.m. or 2:00 p.m. 2640 Golden Gate Pkwy, #206

Thursday, January 27 9:30 a.m. or 1:00 p.m. Naples, FL 34105

th

For Reservations Contact Jenny 239-919-8901 or gcrisci@criscipwm.com

Gary T. Crisci Edward V. Smith, Esq.

AAMS®, ADPA®, CRPC®, Managing Principal, Guest Speaker:

PIM Portfolio Manager, Attorney at Woods,

Accredited Wealth Management Advisor Weidenmiller, Michetti &

gcrisci@criscipwm.com Rudnick.

(239) 919-8901

(888) 224-0792

Our practice is encouraging the public to follow all state, local, federal and CDC ordinances and restrictions in relation to COVID-19 and proper social distancing measures are being

taken. Due to the health risk associated with COVID-19, for the health and safety of everyone who enters Crisci Private Wealth Management, if you are currently experiencing or have

experienced in the past 14 days any of the following symptoms, we respectfully ask that you not attend the seminar: Fever, Chills, Cough, Shortness of breath, Loss of taste or smell. We

remain available to assist your needs and are reachable at (239) 919-8901 or gcrisci@criscipwm.com.

Investment products and services are offered through Wells Fargo Advisors Financial Network, LLC (WFAFN). Crisci Private Wealth Management is a separate entity from WFAFN.

The views expressed by Edward V. Smith Esq. are his own and do not necessarily reflect the opinion of Wells Fargo Advisors Financial Network or its affiliates.

The event is educational in nature – no company specific products will be discussed. Crisci Private Wealth Management is not a legal or tax advisor.

Poinciana Professional Park, 2640 Golden Gate Pkwy., Suite 206, Naples, FL 34105

www.crisciprivatewealth.com

Life in Naples | January 2022 91