https://lifeinnaples.net/wp-content/uploads/2016/05/REVISED-FOURTH-OF-JULY-FLYER.jpg

1490

1172

LifeInNaples

https://lifeinnaples.net/wp-content/uploads/2019/05/LIN-LOGO-2019340by78.jpg

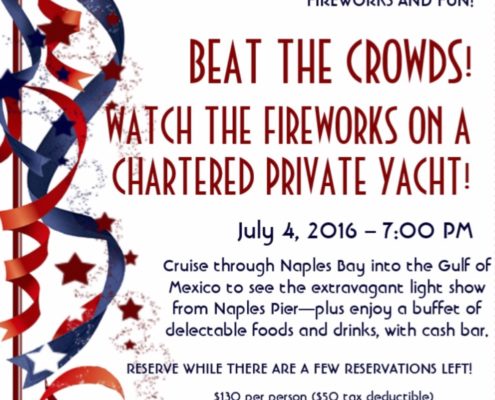

LifeInNaples2016-05-26 15:47:242016-05-28 15:33:15Watch July 4th Parade on Private Yacht!

https://lifeinnaples.net/wp-content/uploads/2016/05/REVISED-FOURTH-OF-JULY-FLYER.jpg

1490

1172

LifeInNaples

https://lifeinnaples.net/wp-content/uploads/2019/05/LIN-LOGO-2019340by78.jpg

LifeInNaples2016-05-26 15:47:242016-05-28 15:33:15Watch July 4th Parade on Private Yacht! https://lifeinnaples.net/wp-content/uploads/2016/05/Life-In-Naples-ad-05-04-16web.jpg

722

600

LifeInNaples

https://lifeinnaples.net/wp-content/uploads/2019/05/LIN-LOGO-2019340by78.jpg

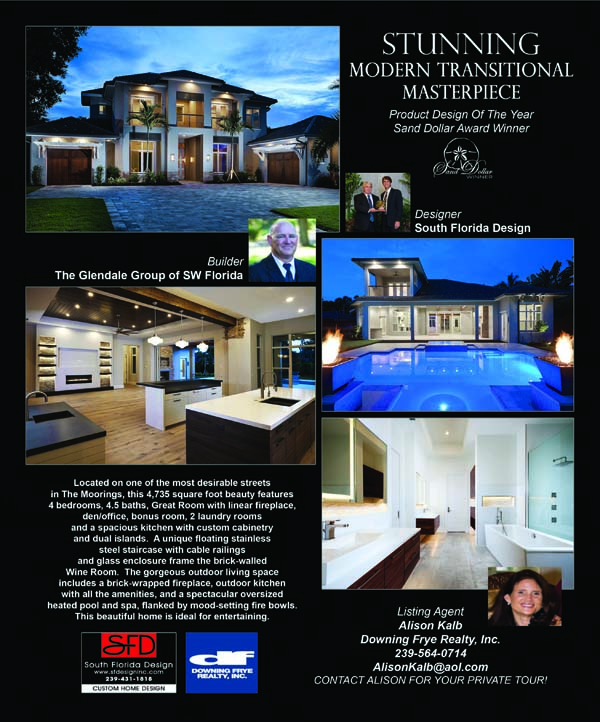

LifeInNaples2016-05-17 17:18:382016-05-26 13:19:45A Stunning, Modern Transitional Masterpiece

https://lifeinnaples.net/wp-content/uploads/2016/05/Life-In-Naples-ad-05-04-16web.jpg

722

600

LifeInNaples

https://lifeinnaples.net/wp-content/uploads/2019/05/LIN-LOGO-2019340by78.jpg

LifeInNaples2016-05-17 17:18:382016-05-26 13:19:45A Stunning, Modern Transitional Masterpiece

Meet & Greet One of America’s Finest

0 Comments

/

FREE & OPEN TO THE PUBLIC

Captain Jerry Yellin, SPIRIT OF…

New Bascom Palmer Eye Institute in Naples

by Amy Lane

Director of Development & Major Gifts

Bascom…

SUMMER IS A PEAK TIME FOR DRUG AND ALCOHOL USE AMONG TEENS

Parents are encouraged to develop a summer plan with this in…

https://lifeinnaples.net/wp-content/uploads/2016/05/paws2.jpg

235

331

LifeInNaples

https://lifeinnaples.net/wp-content/uploads/2019/05/LIN-LOGO-2019340by78.jpg

LifeInNaples2016-05-01 16:20:282016-05-26 13:22:42“THIRD ON CANVAS”

https://lifeinnaples.net/wp-content/uploads/2016/05/paws2.jpg

235

331

LifeInNaples

https://lifeinnaples.net/wp-content/uploads/2019/05/LIN-LOGO-2019340by78.jpg

LifeInNaples2016-05-01 16:20:282016-05-26 13:22:42“THIRD ON CANVAS”

IT’S TIME FOR A SUMMER VACATION OR ADVENTURE

by Catherine Fay,

Owner and VP

It’s an exciting time…

THE TOP FINANCIAL MISTAKES THAT ARE EASY TO AVOID

by Jill Ciccarelli Rapps, CFP®

Financial Advisor

Being satisfied…

RETIREMENT PLAN TAX TIPS: RBDS & RMDS

by Michael Wiener, E.A.

Under general tax principles, IRA…

CHILD PORN VICTIM IDENTIFICATION A CHALLENGE

The images were disturbing: children who appeared to be as…